Project Description

An oil company has leased your minerals and has drilled a well that is going to be producing oil soon. What should you expect in terms of revenue? Obviously, the answer to this depends on several variables unique to your situation: what your royalty rate is, how many acres you own, how many wells are being drilled and how good the geology is where you acreage lies to name a few. What is not variable, however, is the path that the size of these checks will follow over time.

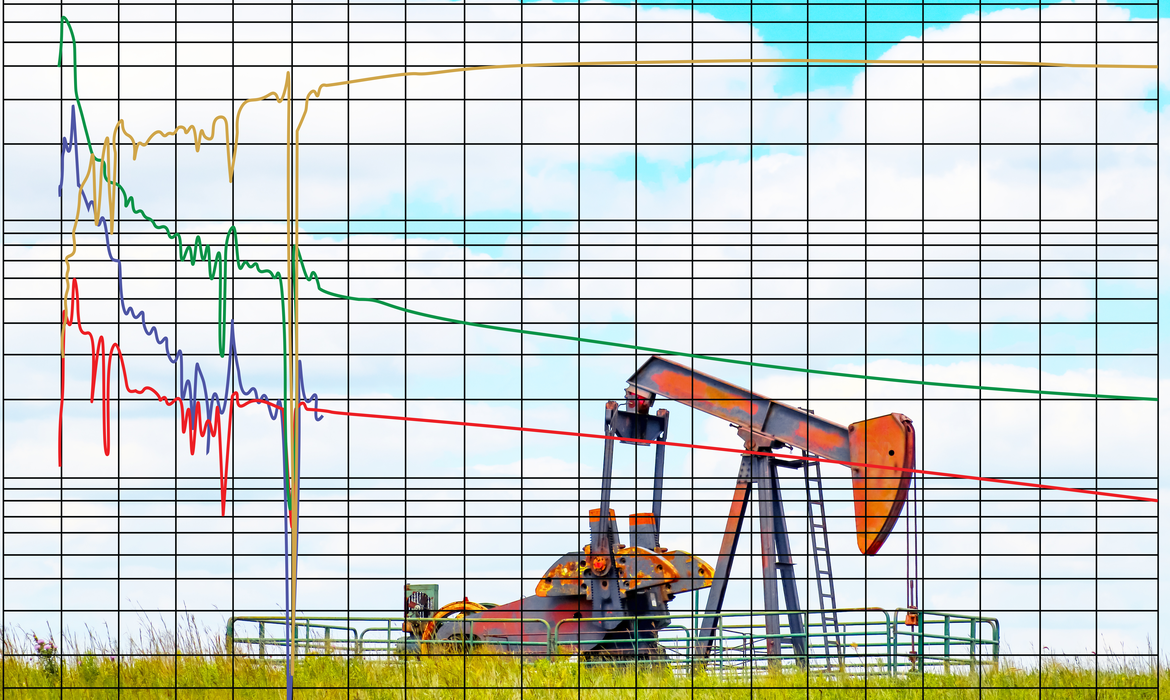

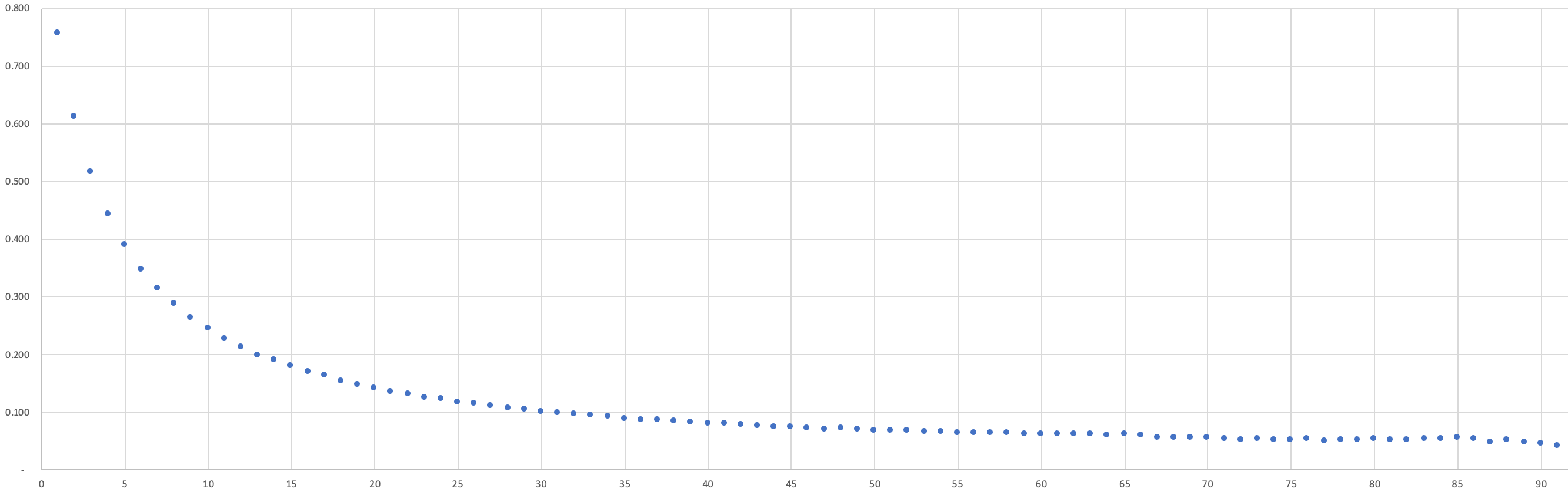

Oil and gas wells are subject to what is known as a decline curve. A decline curve plots the amount of oil (and/or gas) a well will produce during its lifetime. When wells first starting producing, there is a significant amount of pressure in the well that brings large amounts of hydrocarbons (i.e. oil, natural gas liquids, gas, etc) to the surface at a rapid rate. Over time, this pressure decreases and the amount of oil produced falls commiseratively. As can be seen below, this decline is drastic, and by year 3 the monthly production will generally be less than 10% of month 1. The chart below represents nearly 8,000 horizontal wells in Colorado and Wyoming.

It is important as a mineral rights owner that you understand that the income generated by your minerals will follow the same path as above. Any mineral rights owner who has received production checks can attest to this. Your very first check will include several months worth of production as the oil company will usually pay 3-6 months in arrear for this initial payment. This means there will be a significant decrease between your first and second checks, with a continued decline month over month, before eventually more or less leveling off in years five and beyond. Additionally, oil and gas prices will impact your monthly checks. Oil is the most volatile commodity in the world, so it can be difficult to project how much future cash flow your mineral rights will generate. Because of this, many people choose to sell their mineral rights and invest the proceeds in asset class with more stable cash flows not subject to such a significant decline, often times via 1031s exchanges.

Another important fact to remember is that any royalty income you receive is taxed as ordinary income. This means it is taxed at the highest tax bracket that you qualify for. When you complete an outright sale of your mineral rights, it is taxed as capital gains. If you have owned your minerals (inherited or purchased) for more than 1 year, you qualify for long-term capital gains treatment, which is generally about 50% less than the ordinary income tax rate. As mentioned above, people also often take their sale proceeds and invest tax-free via a 1031 exchange. Being able to take advantage of the long-term capital gains tax treatment or deferring taxes indefinitely via a 1031 exchange are common reasons for owners opting to sell their minerals today instead of waiting to collect royalty payments.

If you are interested in learning about your options when it comes to selling your minerals, please get in touch with us at contact@tpgenergy.com.